tempe az sales tax rate 2020

83 Sales Tax Chart Combined State of Arizona Maricopa County City of Phoenix tax due on Retail Sales from 001 to 100. Closed or No Sales.

Cars For Sale Near Gilbert Az Coulter Cadillac Tempe

For single items over 10303 the sales tax rate is 2000.

. Tempe has a lower sales tax than 692 of arizonas other cities and counties. Tempe Az Sales Tax Rate 2020. Apply or Renew on the Accela Citizen AccessACA Portal.

Arizona sales tax changes effective January 2020. Use the physical address or the zip code. Even if you had no sales andor tax due for a filing.

This is the total of state county and city sales tax rates. Impose an additional 200 bed tax. Local General Sales Tax AZ State Sales Tax Globe 330 560 Miami 350 560 All tax rates subject to change without notice.

The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180. Increased to 300 effective January 1 2003. Arizona Tax Rate Look Up Resource.

Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53. However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License. The december 2020 total local sales tax rate was also 6300.

On January 1 2020 the following Mohave County Navajo County the City of Phoenix and the Town of Kearny will all experience TPT rate. 4 rows Tempe Junction AZ Sales Tax Rate. Average Sales Tax With Local.

Tempe Privilege Tax from. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona. Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25.

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az The 81 sales tax. There are a total. The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 18 Tempe tax.

There is a minimum of 25 and a maximum 25 percent of the tax due or 100 per return whichever is greater. There is no applicable special tax. Average sales tax with local.

Prior Combined Tax Rates Phoenix. Arizona Maricopa County Transient Lodging. The minimum combined 2022 sales tax rate for Tempe Arizona is.

What is the sales tax rate in Tempe Arizona. The december 2020 total local sales tax rate was also 6300. The current total local sales tax rate in Tempe.

Sales of food for home consumption will be taxed a different rate effective July 01 2010. You can print a 81 sales.

Tempe Arizona Department Of Revenue

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable

Hawaii 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Used Lexus Rx 350 For Sale In Tempe Az Edmunds

2021 Arizona Car Sales Tax Calculator Valley Chevy

Tempe Arizona The Heart Of The Hip Cool Carol Royse Team

Mesa Poised For Record 2 1 Billion Budget News Eastvalleytribune Com

Red Flags That Trigger A Sales Tax Audit Henry Horne

Residential Commercial Rentals City Of Tempe Az

Home2 Suites By Hilton Phoenix Tempe University Research Park Tempe Az 7200 South Price Rd Tempe Az 85283 85283

2020 Nissan Kicks For Sale In Tempe Az Serving Mesa Used Nissan Sales

Let Your Users Set The Tax Rate

Top Companies To Work For In Arizona 2020

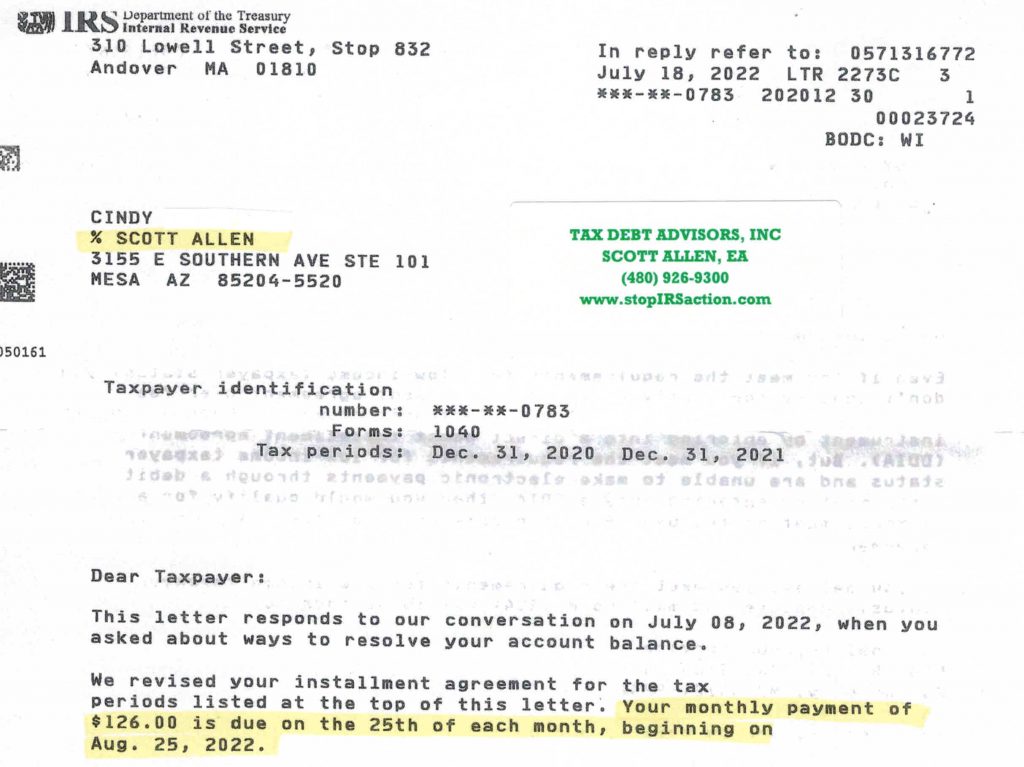

Irs Tax Attorney Tax Debt Advisors

Arizona Income Tax Calculator Smartasset

Arizona Sales Tax Small Business Guide Truic

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Sales Tax In Tempe Az Fill Out Sign Online Dochub

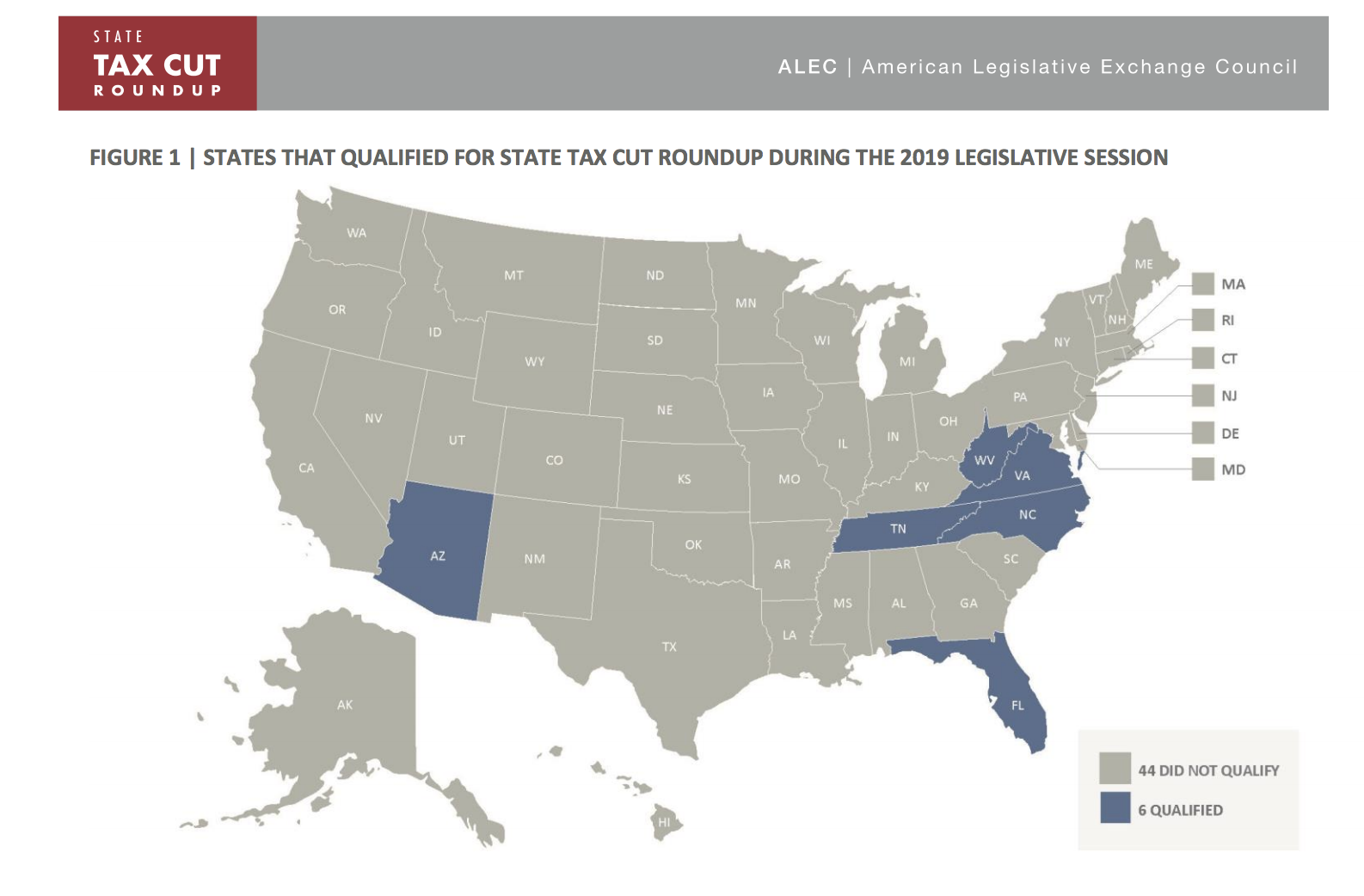

Report Arizona Leads In Tax Relief Office Of The Arizona Governor