sacramento property tax rate 2021

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the owner and publishing annual and supplemental assessment rolls. Ad Enter Any Address Receive a Comprehensive Property Report.

Lowering Auto Insurance Rates Stretcher Com Save Money No Matter What Your Credit Score Autoi Cheap Car Insurance Getting Car Insurance Car Insurance Tips

View the E-Prop-Tax page for more information.

. The minimum combined 2022 sales tax rate for Sacramento California is. Payments may be made by mail or in person at the county tax collectors office located at 700 h street room 1710 sacramento ca 95814 between the hours of 8 am. View the E-Prop-Tax page for more information.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. The sacramento sales tax rate is. The median home value in Fresno County is 237500.

1-916-274-3350 FAX 1-916-285-0134 wwwboecagov December 31 2020. Find All The Assessment Information You Need Here. The County sales tax rate is 025.

Property tax revenue funds over 175 local government agencies including schools special districts such as fire park and community service districts as well. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Unsure Of The Value Of Your Property.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. The property tax rate in the county is 078. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

450 N STREET SACRAMENTO CALIFORNIA. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. On the commercial side the median rate in 2021 was 1739 down from.

Sacramento County Finance. With our guide you will learn important knowledge about Sacramento property taxes and get a better understanding of things to anticipate when you have to pay the bill. Please make your Property tax payment by the due date as stated on the tax bill.

Browse Current and Historical Documents Including County Property Assessments Taxes. Start filing your tax return now. TAX DAY NOW MAY 17th - There are -455 days left until taxes are due.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171. In-depth Sacramento County CA Property Tax Information. The 2021-22 assessment roll will generate approximately 19 billion in property tax revenue.

Property Tax Administrative Fees - SB 2557. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Our Mission - We provide equitable timely and accurate property tax assessments and information.

Paying Your Property Tax The Sacramento County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or. Average Property Tax Rate in Sacramento. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Sacramento Property Tax Rates. Sacramento property tax rate 2021.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Tax Collection and Licensing. Additional exemptions might be available for farmland green space veterans or others.

2021-22 Sacramento County Property Assessment Roll Tops 199 Billion. That means that while property tax rates in Fresno County are similar to those in the rest of the state property taxes paid. This years roll growth will yield an additional 97 million in revenue over last year.

Voter Approved Bond Debt Rates. PO BOX 942879 SACRAMENTO CALIFORNIA 94279-0064. 2021-22 CALIFORNIA CONSUMER PRICE INDEX Revenue and Taxation Code section 51 provides that base year values determined under.

Ultimate Sacramento Real Property Tax Guide for 2021. 10000 Los Rios Coll Gob. A delinquency penalty will be charged at the close of the delinquency date.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. Notice that 2021-2022 tax rates were used since 2022-2023 values are not available yet. Fiscal Year 2015-2016.

The assessment roll is the total gross assessed value of locally assessed real business and personal property in Sacramento County. Tax Collection Specialists are available for customer assistance via telephone at 916 874-6622 Monday Friday from 900am to 400pm or via email at TaxSecuredsaccountygov. Tax Collection and Licensing.

Sacramento Property Tax Rate 2021. The median property tax on a 32420000 house is 220456 in Sacramento County. PROPERTY TAX DEPARTMENT.

All are public governing bodies managed by elected or appointed officers. See Results in Minutes. Learn more About Us.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Tax description Assessed value Tax rate Tax amount. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Property Taxes By State Quicken Loans

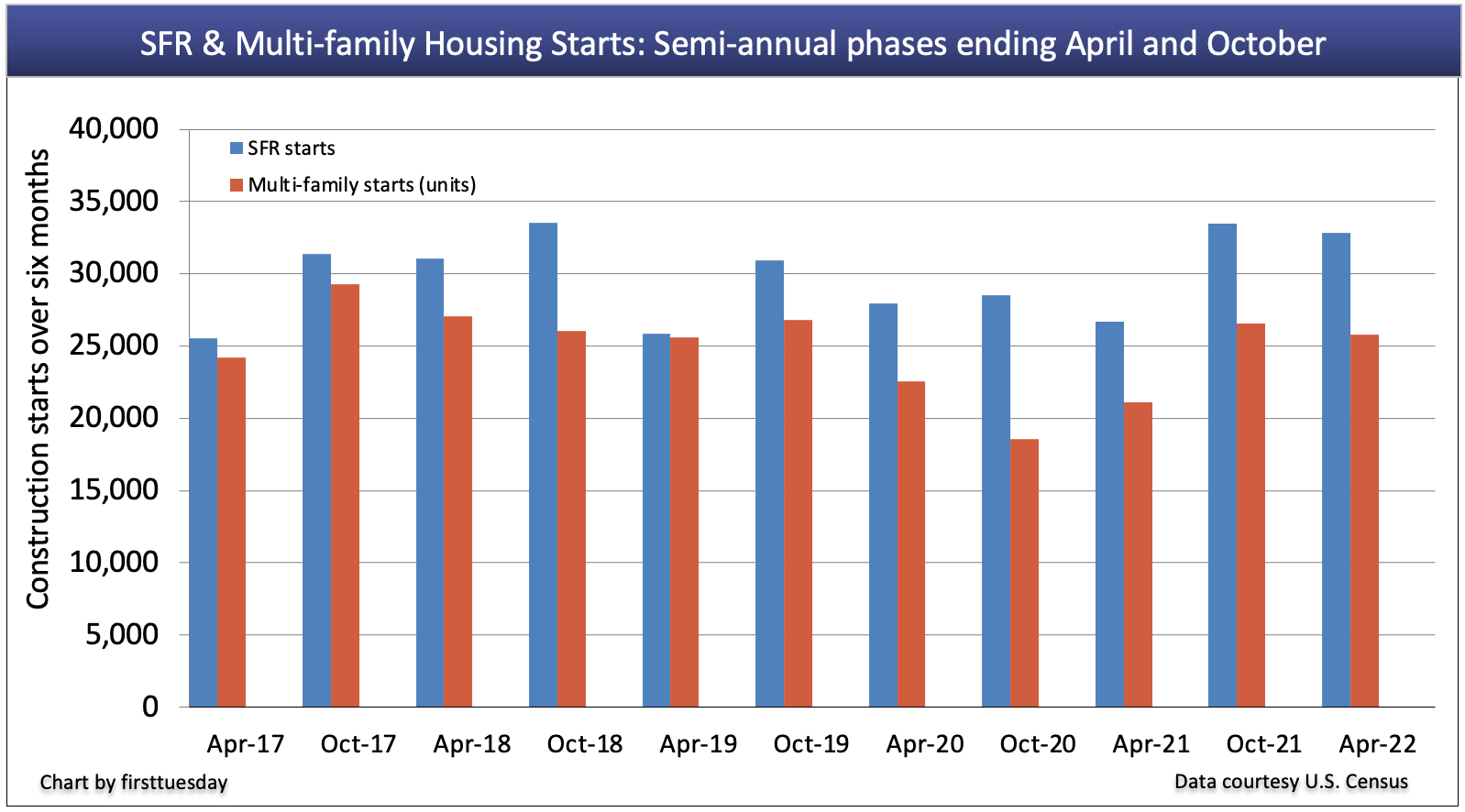

A Bump Up Moment In California Construction Starts Firsttuesday Journal

What Is A Reverse Mortgage Money Money

Payroll Calculators California Payroll

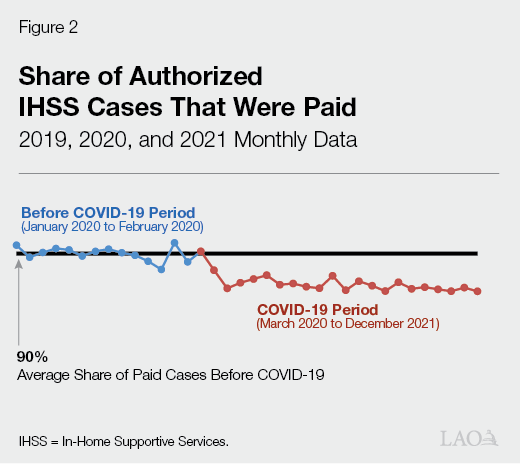

The 2022 23 Budget In Home Supportive Services

Sacramento County Ca Property Tax Search And Records Propertyshark

November Home Prices Rose 9 5 One Of The Highest Gains On Record Case Shiller Says Moving To Idaho House Prices Sacramento County

Property Taxes Department Of Tax And Collections County Of Santa Clara

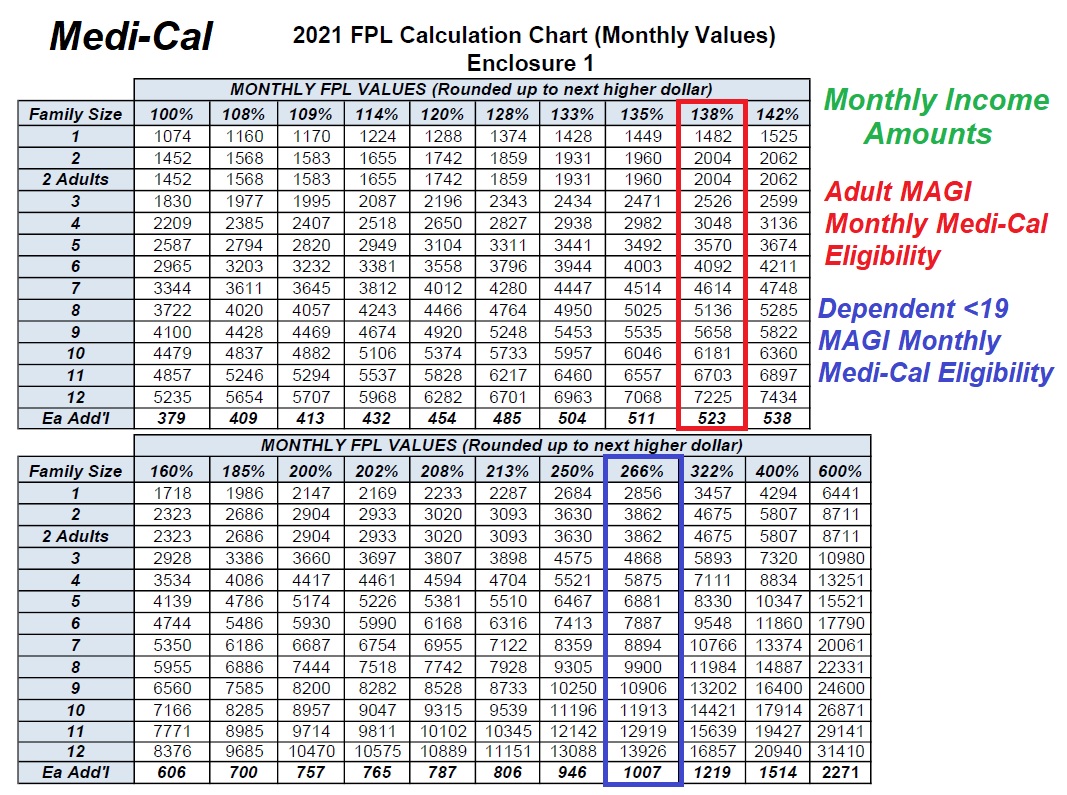

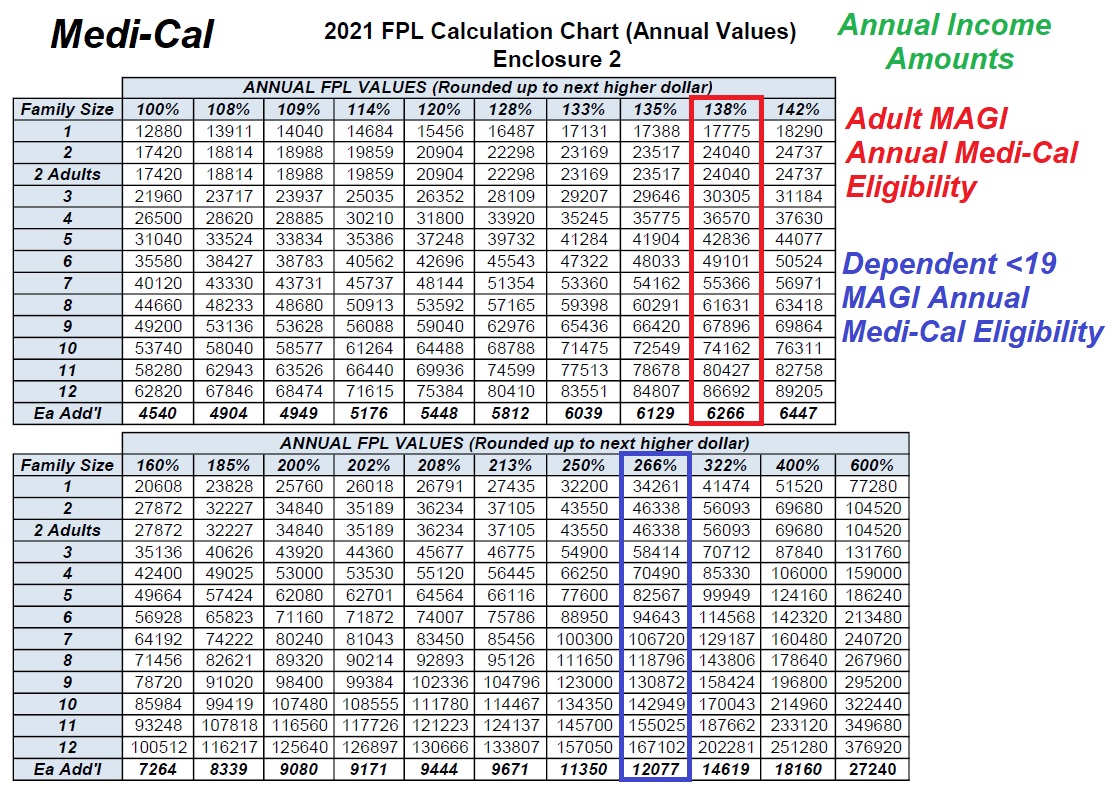

2021 Medi Cal Income Amounts Modest Increase Fpl

Property Taxes Department Of Tax And Collections County Of Santa Clara

2021 Medi Cal Income Amounts Modest Increase Fpl

2021 Momentum 397th By Grand Design Uvw 15600 Lbs Hitch Weight 3375 Lbs Length 43 1 Grand Designs Tiny House Living Grand Design Rv

Property Tax California H R Block

Highest Gas Tax In The U S By State 2022 Statista

Property Taxes Department Of Tax And Collections County Of Santa Clara